Cedar Austrian Economics ESG Investment Strategy

Download our White Paper – Click Here

The Cedar Austrian Economics ESG Index is an actively managed portfolio of businesses targeting a dual focus of helping society and the environment with outperforming portfolio returns.

We are a signatory to the UN Principles for Responsible Investment (PRI). We take an integrated view of ESG, Socially Responsible and Impact Investing – while many portfolios only look at ESG, we integrate all three! We seek to be active owners in the businesses of the portfolio.

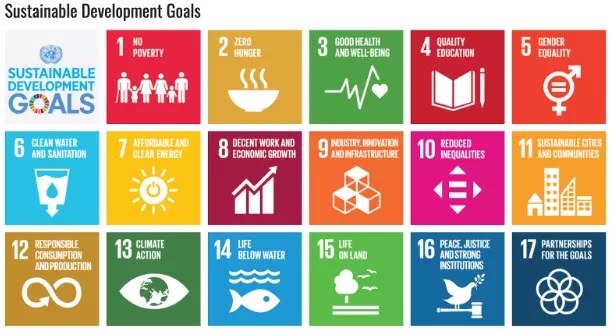

We emphasize successful businesses in the economy with great ESG metrics that implement the 17 United Nations Sustainable Development Goals (SDGs). This approach is unique as other investment portfolios seek businesses meeting pre-defined ESG and SDG objectives, which may not necessarily result in identifying successful, outperforming businesses in the economy and financial markets.

We strongly believe in stakeholder versus shareholder focus, with value benefitting all stakeholders, not just shareholders. There are many studies supporting the synergistic value to focus on all stakeholders – customers, investors, communities, government, employees and the environment!

Our Research Strategist is industry veteran Yra Harris – Yra has decades of experience as a Floor Trader, and served as a Board Member of the Chicago Mercantile Exchange (CME). He frequently appears on CNBC and other global media outlets to provide perspective and insight into the economy and financial markets.

Our investment philosophy uses the principles of a unique school of thought known as the Austrian School of Economics (ASE), placing emphasis on enduring businesses with high free cash flows, minimal or manageable debt, and stores of value. This represents a powerful advantage in an era beset with excessive debt and leverage. The approach assesses seven quantitative factors and seven qualitative factors, distilled from the principles of the ASE.

The portfolio currently holds over 35 great businesses from around the world.