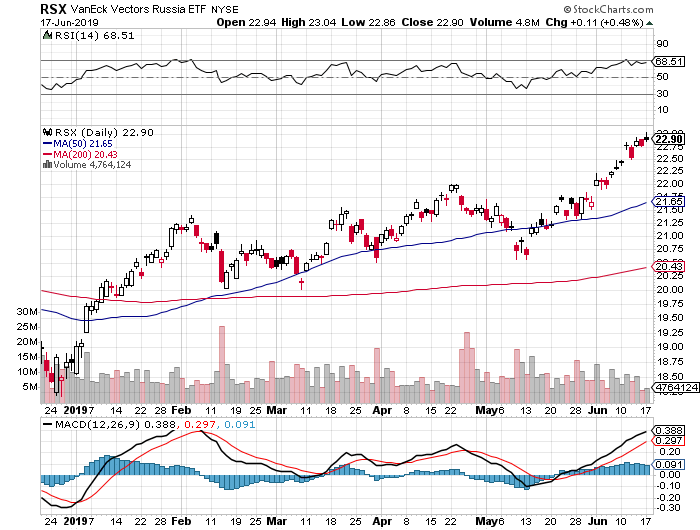

Date: June 17, 2019

Background: “There has been strange movement in a stock I have discussed for quite awhile, the Russian ETF RSX. This stock has traded higher even as the overall market has been weak. In defiance of recent correlative properties RSX has rallied with a $10 drop in crude oil prices. When oil prices were trading close to $75 in October, RSX was trading $21.80. But today OIL is $52 and the ETF is trading above $22. Something positive is developing in the state of Russia. This is important for my analysis of global events as it MAY portend that U.S. sanctions may be coming off the Russian economy. Last week. President Putin pulled back on some of his support for Maduro in Venezuela. And this was after Secretary of State Mike Pompeo went to Moscow on May 12.

Furthermore, there are rumors that Russia is pushing hard on Iran to curb its activities in Syria as Israeli strikes on Iranian ammo depots have increased. Has Putin leveraged his ability to foment discord in the Middle East to get relief from the sanctions that have burdened the Russian economy? If so, then RSX and its 4.5% dividend (and low P/E) may be an interesting investment. (Note: I currently have a position and bought more Wednesday. I’m not touting, but merely observing price action that is diverging from recent correlations.) When algorithmic relationships break down it’s time to pay attention.”

– Yra Harris, June 5 2019 – link to source

Trading Opportunity: LONG on RSX – VanEck Vectors Russia ETF

Chart: