Background: Key results from the G20 Meeting: U.S. President Trump held off from installing additional tariffs on China, while China President Xi confirmed that China would be buying more U.S. production, especially in the agricultural sector.

Potential Implications: China may import more U.S. agricultural products. If so, keep an eye on the grain futures markets and on agricultural equities.

Perspectives: Consider U.S. agricultural futures or options. Also consider agricultural equities which have been under-performing with a relatively low risk profile on a fundamental basis – although it is to be pointed out that the management of agricultural businesses have been generally mediocre at best.

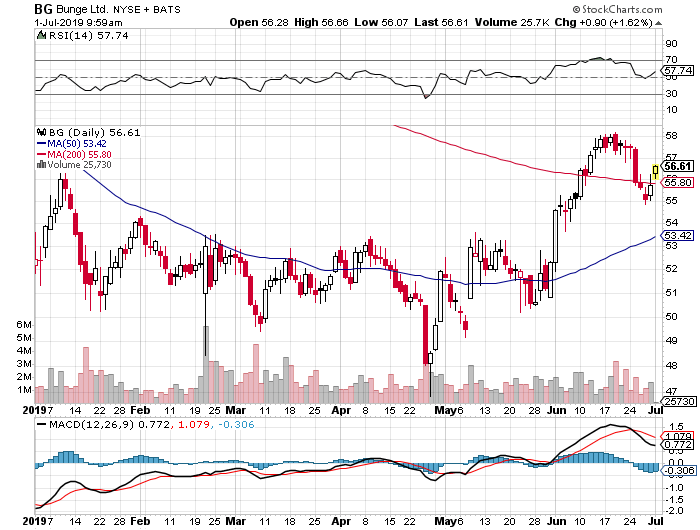

Here is the chart of one agribusiness – Bunge – showing it above the 200 day moving average:

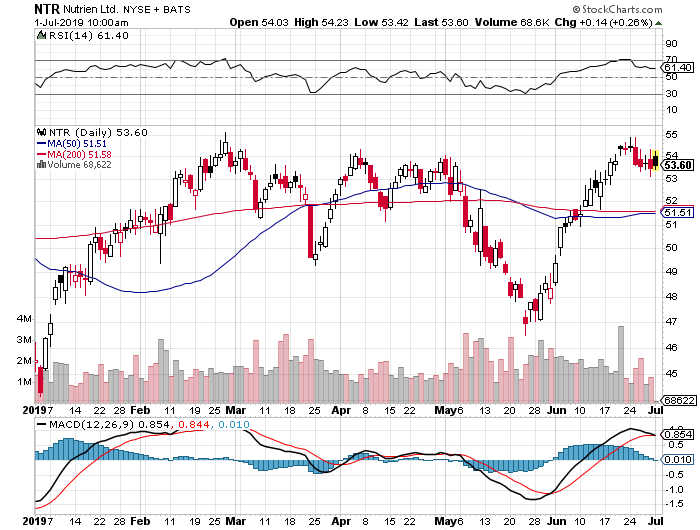

Agricultural fertilizer businesses are also interesting. Here is the chart of one fertilizer company – Nutrien:

Additional: Keep an eye on what what happens with interest rates between the European Central Bank (ECB) and the Federal Reserve. Gold may be responding to central bank actions. Given the U.S./China trade war, the Fed may remain on hold rather than cutting to buy insurance against a tariff-induced slowdown. This could translate into a backup from the recent lows in U.S. yields, and if U.S. yields rise relatively higher, it should send the U.S. dollar higher and gold lower.